Introduction

In a bold regulatory move, the Real Estate Council of Ontario (RECO) has secured court orders to freeze the assets of the former principals of iPro Realty Ltd. The decision follows complex allegations around missing or misused trust funds, diversion of deposits, and intercompany transfers.

As the legal drama unfolds, it’s critical for buyers, sellers, and real estate professionals across Ontario to understand what this means—both for immediate transactions and for broader industry trust.

Background: The Collapse of iPro Realty

On August 19, 2025, iPro Realty shuttered its 17 offices, affecting approximately 2,400 agents. (REM)

At the time, RECO revealed a shortfall of $10.5 million from the brokerage’s trust accounts. (REM)

But further forensic investigations suggest a far larger and more intricate diversion of funds, reportedly nearing $30 million. (REM)

The newly uncovered evidence presents a web of transactions where funds that should have been held in trust were commingled, routed to general accounts, or transferred to affiliated entities. (REM)

What Court Orders Were Granted

1. Mareva Injunction (Asset Freeze)

Justice William Black of the Ontario Superior Court granted a Mareva injunction that bars the respondents from disposing, transferring, or hiding assets until the litigation is resolved. (REM)

2. Norwich Relief / Document Production

A Norwich order compels banks and financial institutions to hand over records of accounts and assets held in the names of the respondents. This is central to tracing where trust funds went. (REM)

3. Carve-Outs for Living & Legal Expenses

The court allowed the ex-principals to apply for a limited carve-out authorizing use of certain funds for ordinary living expenses and legal representation. This ensures the freeze isn’t absolute. (REM)

4. Named Respondents & Entities

The litigation doesn’t just name founders Fedele Colucci and Rui Alves, but also several associated companies they direct or control, such as:

IP Holding Realty Ltd.

Hippo Holdings Corporation

Sutton Group Professional Real Estate Services Inc.

Alco Motors Ltd.

Alco Rent-A-Car Ltd. (REM)

These entities are alleged to have “knowingly assisted” in the diversion of funds or to have received monies impressed with a trust. (REM)

Forensic Findings & Alleged Money Flow

RECO’s evidentiary filings uncover a pattern of systematic misuse:

$14.3 million was transferred electronically from trust to general accounts. (REM)

$10.1 million was moved by cheques. (REM)

Around $2.63 million in cheques originally intended for trust accounts were deposited into incorrect destinations. (REM)

iPro Inc. transferred $3.4 million from trust to general accounts, with additional internal transfers between affiliated entities. (REM)

Payments directly benefiting the principals and their families were traced:

• Colucci: ~$172,864 (via iPro general account) + further sums via other entities (REM)

• Alves: ~$108,145 from iPro general accounts (REM)

• Spouses and related parties also received funds (e.g., Alves’ spouse’s corporation) (REM)

RECO characterizes the scheme as a serious breach of fiduciary, statutory, and ethical duties, causing harm not only to individual clients and registrants but to the integrity of Ontario’s real estate system. (REM)

Impacts & Risks

For Consumers & Agents

Clients may struggle to recover deposits or retain trust protections if funds were never properly held in trust.

Agents tied to iPro risk missing commissions, liability claims, or reputational damage.

Closing deals may face legal or financial obstacles if trust fund shortfalls disrupt transactional flows.

For the Founders & Associated Entities

The freeze curtails efforts to move or hide assets, though defenses will likely raise motions challenging the orders.

Legal defense costs could be steep; the permitted carve-outs will be closely monitored.

Entities named in the lawsuit face potential liability for complicity, receiving improper transfers, or aiding breaches of trust.

For the Real Estate Sector & Regulators

This case may set a precedent for aggressive regulatory action in trust fund mismanagement cases.

Brokerages may face enhanced audits, tighter compliance standards, or stricter reporting rules.

Public trust in multi-office brokerages could erode, affecting overall business confidence.

What Happens Next

Asset Tracing & Disclosure

The Norwich orders will push banks to disclose account details, enabling RECO and its forensic team to trace diverted funds.

Defendants’ Motion Responses

Colucci, Alves and their counsel will likely file motions to contest or reduce the scope of the orders, especially around permissible expenses.

Judicial Rulings on Liability

Eventually, the court must adjudicate whether the defendants are liable and how much restitution or recovery is owed.

Potential Criminal or Regulatory Referrals

While this matter is currently a civil/regulatory action, the severity of the allegations may invite criminal investigations or referrals to law enforcement.

Key Takeaways & Advice

Trust funds must remain beyond reproach. Misuse, commingling, or diversion is a red line that regulators and courts will aggressively pursue.

Brokerages must invest in tight internal controls and transparency. Segregation of trust vs operating accounts, regular audits, and clear accounting trails are nonnegotiable.

Clients and agents should demand disclosure. Always verify how deposits are held and how a brokerage maintains trust compliance.

Regulatory scrutiny is intensifying. Real estate professionals should anticipate new rules, audits, or compliance obligations ahead.

Call to Action

Are you buying, selling, or investing in Ontario real estate? Now is the time to ensure full protection of your deposits and transactions.

Reach out to Sami Chowdhury, Broker – RE/MAX Realtron Realty Inc.

📞 647-725-0606 | ✉️ samichy@torontobase.com

🌐 TorontoBased.com | TorontoBase.ca

Let’s make sure your real estate dealings are safeguarded by transparency, trust, and accountability.

Source & References

“RECO lands court order to freeze iPro founders’ assets,” Real Estate Magazine (REM)

“This is where the iPro trust money went, according to RECO evidence,” Real Estate Magazine (REM)

Ready to Start Your Real Estate Journey?

Whether you're planning to buy, sell, or invest, I’m here to guide you every step of the way — surprises and all.

Looking to capitalize on today’s changing market?

Explore a wide range of specialized listings with access to powerful tools and search portals tailored to your needs:

Gas Stations for Sale

Commercial & Industrial Properties

Residential Homes Across the GTA

Hotels & Motels Investment Opportunities

Pre-Construction Condo Projects

Condo Resale Listings in the GTA

Stay ahead of the curve! Get the latest real estate news and insights right here.

Need help navigating your options?

Reach out for expert advice and market insights:

Sami Chowdhury

BROKER

Email: samichy@torontobase.com

Web: www.torontobased.com | www.torontobase.ca

Let’s make your next move a smart one!

Read more about the market developments And MY Blogs.

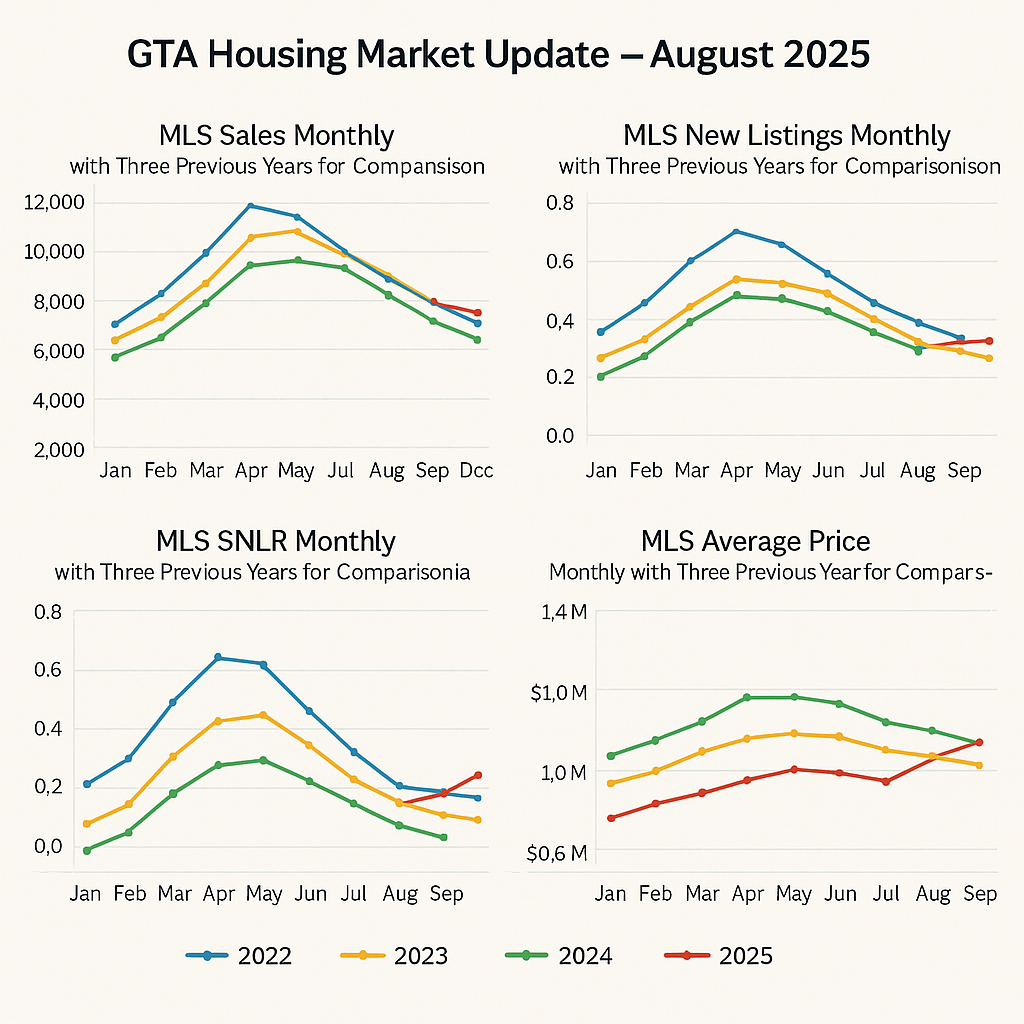

GTA Housing Market Update – August 2025

Canada’s Economy Stumbles in August: 66,000 Jobs Lost, Unemployment Soars to 7.1%

Greater Toronto Area (GTA) Housing Market Update – May 2025

Stay ahead of the curve! Get the latest real estate news and insights right here.

Greater Toronto Area (GTA) Real Estate Market Update – April 2025

Toronto Real Estate Market Update – March 2025

Peel Region Real Estate Market Blog – March 2025

Renting vs. Owning: How $2,500/Month Could Cost You $190,000

Metro Vancouver Condo Inventory Could Rise 60 by Year End Report

.png)