📍 Scarborough Real Estate Market Blog – March 2025

Scarborough, located in Toronto’s east end, continues to deliver strong value and steady performance across its residential real estate segments. In March 2025, the area saw consistent sales activity, particularly in family-friendly neighborhoods like Birch Cliff, Bendale, and Woburn. For buyers seeking space, transit access, and affordability within city limits, Scarborough remains one of the best-positioned markets.

📊 Market Highlights (Estimated):

Average Selling Price: $875,000

Average Listing Days on Market (LDOM): 26 days

Sales-to-List Price Ratio: 98.5%

🏘️ Neighborhood Performance

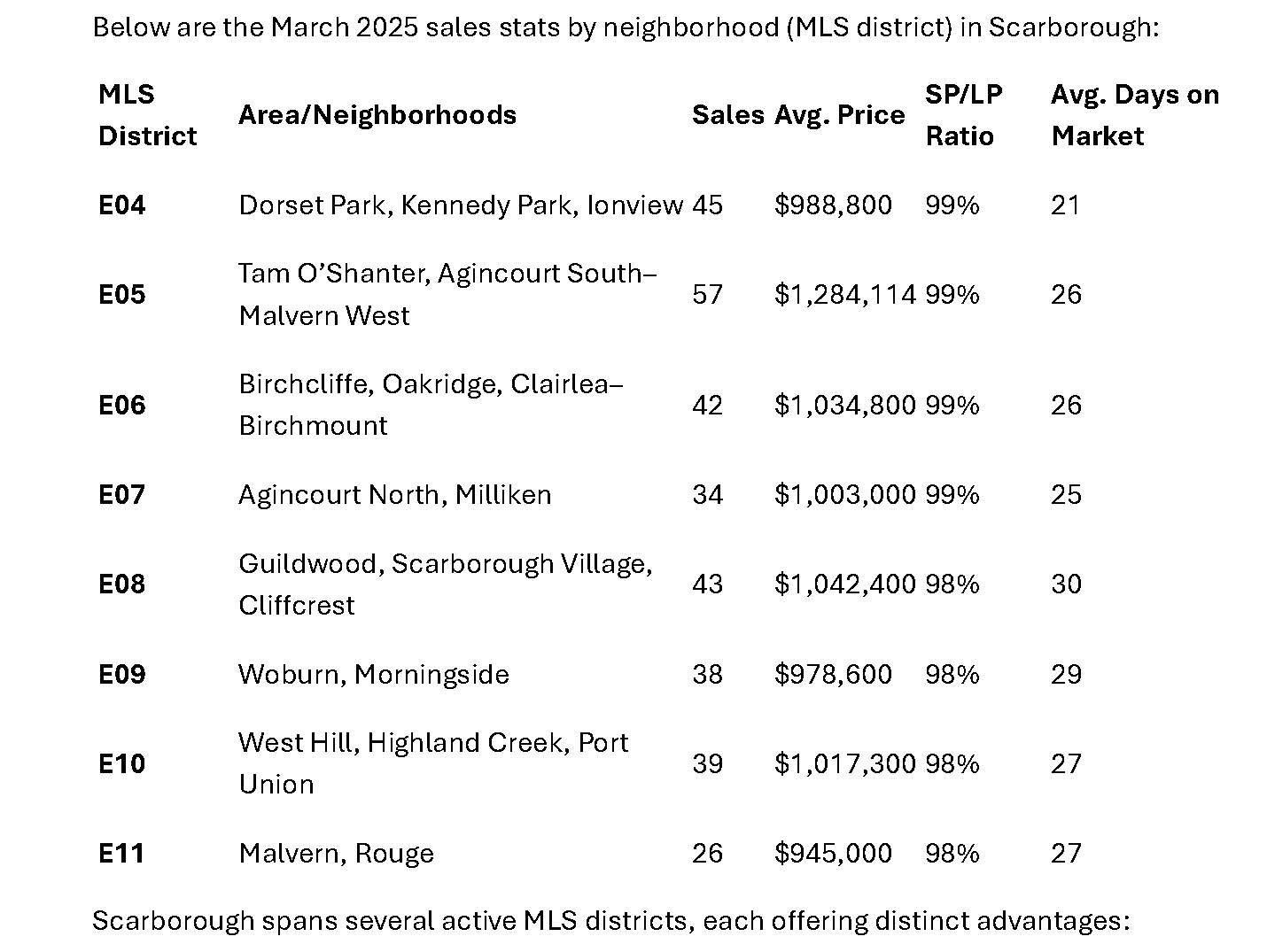

Scarborough spans several active MLS districts, each offering distinct advantages:

🗂️ E04 – Dorset Park, Kennedy Park, Ionview

Bungalows and semis popular among first-time buyers.

Strong transit access via Kennedy Subway and GO.

Fast-moving homes under $1M.

🗂️ E05 – Tam O’Shanter-Sullivan, Agincourt South-Malvern West

Mix of 2-storey homes and newer townhomes.

Family-friendly, close to STC and schools.

Stable pricing with high family demand.

🗂️ E06 – Birchcliffe-Cliffside, Oakridge, Clairlea-Birchmount

Character homes with lake access and development potential.

Attracting renovators and professionals.

Gentrifying with solid long-term growth.

🗂️ E07 – Agincourt North, Milliken

Spacious detached homes, popular among extended families.

High-ranking schools and diverse amenities.

Competitive prices just under $1M.

🗂️ E08 – Guildwood, Scarborough Village, Cliffcrest

Larger homes on generous lots.

Lakefront lifestyle, close to GO transit.

Premium homes moving steadily.

🗂️ E09 – Woburn, Morningside

Affordable condos and bungalows.

Centennial College & UofT Scarborough campus nearby.

Ideal for first-time buyers and investors.

🗂️ E10 – West Hill, Highland Creek, Port Union

Suburban appeal with a blend of condos and detached homes.

Scenic neighborhoods near Highland Creek and waterfront trails.

Increasing interest from GTA relocators.

🗂️ E11 – Malvern, Rouge

Diverse housing mix including townhomes and newer detached homes.

Accessible to Hwy 401, Rouge Park, and Malvern Mall.

One of the more affordable areas, ideal for first-time buyers and investors.

Suburban appeal with a blend of condos and detached homes.

Scenic neighborhoods near Highland Creek and waterfront trails.

Increasing interest from GTA relocators.

🔍 Buyer & Seller Insights

For Buyers: Scarborough offers tremendous upside value. With inventory levels climbing modestly and prices holding stable, buyers have time to explore options. Many homes are selling with conditions, signaling less bidding pressure than central Toronto.

For Sellers: Homes that are well-maintained and priced right are moving swiftly. With an average of just 26 days on market and a 98.5% sale-to-list ratio, sellers can feel confident when listing — particularly in school-focused or transit-accessible zones.

🔄 Market Trends

The market remains balanced, with neither buyers nor sellers fully in control. However, as interest rates ease and more first-time buyers re-enter the market, expect renewed competition in entry-level and mid-tier properties.

Scarborough's long-term value is further supported by ongoing infrastructure investments, including the Eglinton East LRT extension and waterfront revitalization plans.

🧭 Final Word

Scarborough continues to strike the perfect balance: affordability, accessibility, and livability. Whether you're purchasing your first home, upsizing for more space, or investing in a diverse and growing community, March 2025 shows that Scarborough is still on the rise.

Source: Toronto Regional Real Estate Board (TRREB) Market Watch – March 2025

🏡 Ready to Start Your Real Estate Journey?

Whether you're planning to buy, sell, or invest, I’m here to guide you every step of the way — surprises and all.

📈 Looking to capitalize on today’s changing market?

Explore a wide range of specialized listings with access to powerful tools and search portals tailored to your needs:

📩 Need help navigating your options?

Reach out for expert advice and market insights:

Sami Chowdhury

📧 Email: samichy@torontobase.com

🌐 Web: www.torontobased.com | www.torontobase.ca

Let’s make your next move a smart one!