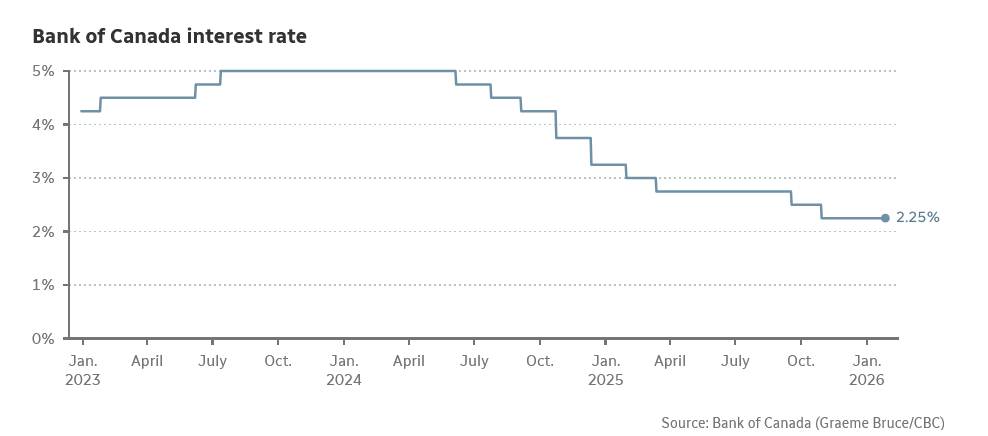

The Bank of Canada has once again held its benchmark interest rate at 2.25%, signaling stability for borrowers — but not certainty for the broader economy.

While inflation remains close to the Bank’s 2% target, policymakers are increasingly focused on external risks, particularly the upcoming review of the Canada–U.S.–Mexico Agreement (CUSMA). Governor Tiff Macklem warned that trade relations with the U.S. are becoming less predictable, adding pressure to Canada’s export-driven economy.

Economic growth slowed toward the end of last year as tariffs and trade friction weighed on exports. Looking ahead, the Bank expects modest GDP growth in 2026–27, suggesting limited upside momentum.

For households, this rate pause provides breathing room. Mortgage rates are unlikely to rise in the near term, and economists suggest the Bank’s next move would more likely be a cut if growth weakens further.

Bottom line: inflation may be under control, but trade risk is now the biggest wildcard influencing interest rate policy.

Source: CBC News